Romesh Navaratnarajah • June 16, 2015

With waning interest from Singaporeans, will it be boom or bust for the special economic zone.

The history between Singapore and Johor is a long and interesting one spanning centuries and one that is often intertwined.

With a history spanning back since the 14th century when Singapore was once the seat of governance for the Johor Sultanate to the signing of the treaty with the British in the 18th century, our history and economy are often inextricably linked although we are now a sovereign state.

Johor Royal Mauseoleum

While the imposing palace in Singapore still remains today, it has been converted to a mosque housing the Johor Royal Mausoleum and where members of the royal household are laid to rest at a nearby cemetery – a reminder of its glorious past.

Over the other side of the causeway, however, is where Johor’s exciting future lies – Iskandar Malaysia.

Home to the current Sultan of Johor, it appears our history is set to intertwine yet again with Iskandar Malaysia as a sort of hinterland for Singapore, as the Sultan admits.

“The future is in Johor because Singaporeans, not just Chinese, will be buying homes in Johor. Homes are already beyond the reach of ordinary Singaporeans over there. It is a political issue when the middle-class find themselves squeezed,” Sultan Ibrahim Ibni Almarhum Sultan Iskandar told The Star recently.

From sceptism to optimism – the Singapore factor

When Iskandar Malaysia was first mooted in 2006 by former Malaysian Prime Minister Abdullah Badawi, Singaporeans were very sceptical about it.

It was only after the land swop deal was concluded in 2010, did sentiment turn positive.

Led by both the Singapore and Malaysian governments, both countries had agreed to jointly develop two iconic projects in Medini via Temasek Holdings and Khazanah Nasional.

Subsequently, Temasek Holdings via CapitaLand entered into a joint-venture agreement with Iskandar Waterfront Holdings to develop a land parcel at A2 Danga Island.

These factors gave Iskandar Malaysia the much needed confidence booster among Singaporeans to snap up properties just across the causeway.

At the peak of the market in 2013, almost 74 percent of non-Malaysian property buyers were from Singapore, according to data from UEM Sunrise.

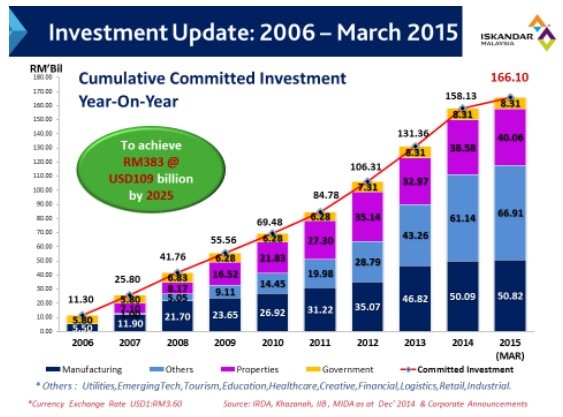

Figures from Iskandar Regional Development Authority (IRDA) also showed that Iskandar Malaysia had secured RM24.87billion in new investments from January 2014 to October 2014.

From 2006 to October 2014, Iskandar Malaysia recorded RM156.51 billion in total cumulative committed investments.

Of this total, 51 percent or RM79.17 billion represent investments that have been realised.

Singapore remains the top foreign investor.

Has Iskandar lost its appeal?

While Singaporeans will still look to Iskandar Malaysia to buy a property, buying activity is admittedly, not as robust as before.

Anecdotal evidence on the ground shows some developers are having problems moving units while property launches are not as well-received as before.

Various factors such as property cooling measures announced during Budget 2014, the flurry of project launches by Chinese developers and the recent toll hikes on both sides of the causeway are causing some to stay away.

With Singapore as the top foreign investor, will this spell the end for Iskandar Malaysia?

Singapore investments include Ascott Somerset Puteri Harbour, Puteri Cove, Motorsports City and Vantage Bay, just to name a few.

Too big to fail

While the Singapore factor may have given Iskandar Malaysia a boost on the international stage due to Singapore being a global city, it is unlikely Iskandar Malaysia will fail.

Here’s why.

While Singapore may be the top foreign investor, majority of the investment are still driven by the domestic market.

Data from IRDA showed that RM102.34 billion or 62 percent of the total cumulative investment were from Malaysia while the rest – RM63.76 billion (or 38 percent) – were contributed by foreign investors.

In addition, the residential property sector forms only RM40.06 billion of the total cumulative investments.

Majority of the investments were driven by the manufacturing sector at RM50.82 billion.

Perhaps the biggest catalyst will be the cross-border rail link service linking Singapore’s MRT to Johor Bahru’s RTS system.

Once completed in 2019, it will result in more investments in Iskandar Malaysia and this is something the current Sultan of Johor had noted.

“Once the links are in place, it will become the norm for Singaporeans to live in Johor and work in Singapore. That is the future,” he told The Star.

Likewise, investors are also looking forward to the linking.

As the RTS-MRT link shows, even as we brace towards the future, our history and economies remain inextricably intertwined.

Like it or not, Singapore still needs Iskandar Malaysia as much as it needs Singapore.

Image: Kota Iskandar, Johor’s new administrative centre. (Photo by IRDA)

Source: http://iskandarinsider.com/wp-content/uploads/2013/06/iskandar.jpg

For more info please visit our website: http://www.smartouch.com.sg

Visit our blog at: http://smartouchint1.blogspot.my/

Click here to subscribe our youtube video

Click here to follow our facebook page to gain more info

Click here to follow our blog for more promotion & product

Click here to learn more about BCA

Click here to learn more about payroll

Click here to learn more about attendance

No comments:

Post a Comment