Singapore Tax Guide For Personal Income

Check this out for more information on you Personal Income Tax here...

Personal income tac rates in Singapore are one of the lowest in the world. In order to determine the Singapore income tax liability of an individual, you need to first determine the tax residency and amount of chargeable income and then apply the progressive tax rate to it. Key points of Singapore income tax for individuals include:

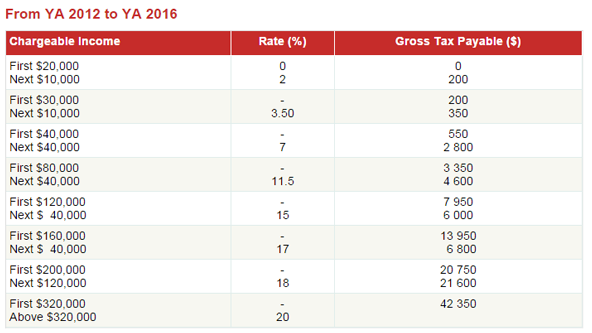

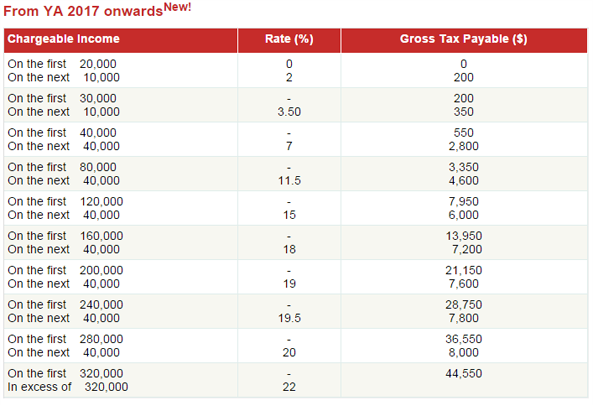

Singapore follows a progressive tax rate starting at 0% and ending at 20% above S$320,000 (From2016 onwards: will end at 22% above S$320,000).

- There is no capital gain or inheritance tax.

- Individuals are taxed only on the income earned in Singapore. The income earned by individuals while working overseas is not subject to taxation barring few exeptions.

- Tax rules differ based on the tax residency of the individual.

- Tax filing due date for individuals is April 15 of each year. Income tax is assessed based on a preceding year basis.

Personal Income Tax Rates

Individuals resident in Singapore are taxed on a progressive tax rate as listed below. Filling of personal tax return is mandatory if your annual income is S$22,000 or more. You do not need to pay tax if your annual income is less than S$22,000. However, you may still need to file a tax return if you have been informed by Singapore tax department to submit your tax return.

Source: IRAS

Different income tax rules apply in Singapore depending on the tax residency status of the individual.

Personal Tax for Singapore Residents

You are considered a tax resident if you are:

- a Singaporean; or

- a Singapore Permanant Resident and have established your permanent home in Singapore; or

- a foreigner who has stayed or worked in Singapore for 183 days or more in the tax year

- Total income means:

- gains or profits from any employment

- dividends, interests, investment income

- rents, royalties, premiums and other profits arising from properties

- exclude qualified income earned overseas (more deails provided later in the guide).

- Expenses means

- qualified rental related expenses are expenses

- Donations means

- Personal Reliefs means

Chargeable income is this adjusted income after deductions from the total income (as shown in the picture above).

Personal Tax for Singapore Non-Residents

Your are considered a non-resident for tax purpose if you are a foreigner who stayed or worked in Singapore for less than 183 days in the tax year. As a non-resident, you will be taxed as below:

Your employment income is exempt from tax if you are here on short-term employment for 60 days or less in a year. this exemption does not apply if you are a director of a company, a public entertainer or exercising a profession in Singapore. Professionals include foreign experts, foreign speakers, queen's counsels, consultants, trainers, coaches etc.

If you are in Singapore for 61-182 days in a year, you will be taxed on all income earned in Singapore. You may claim expenses and donations to save tax. however, you are not eligible to claim personal reliefs. Your employment income is taxed at 15% or the Director fees, consultant fees and all other incomes are taxed at 20%.

Filing personal income tax returns

Filing your tax return is a yearly obligation for every eligible taxpayer. All completed forms must be submitted to Singapore tax department by the 15th of April.

You do not need to pay tax if your annual income is less than S$22,000. However, you may still need to file returns if you have been informed by tax authority to submit your tax form. Even if you do not have any income in previous years, you still need to declare zero income in your tax form and submit by 15 Apr. You need to compulsorily file tax returns if your annual income is S$22,000 or more.You can choose to file your returns online or by mail. IRAS will send you the appropriate paper tax form, as listed below, during February to March.

1. For tax resident individuals - Form B1

2. For self-employed - FormB

3. For non-resident individuals - Form M

You will be subject to penalties for filing late or not filing.

After you have filed your returns, you will receive your Notice of Assessment or ta bill by September. The tax bill will indicate the amount of tax bill and state your reasons for objection.

You need to pay the full amount of tax within 30 days of receiving your Notice of Assessment. this regardless of whether you have informed tax authority about your objection. If your tax remains outstanding after 30 ndays, a penalty will be imposed.

Tax treatment of income earned overseas

Generally, overseas income received in Singappore on or after 1 Jan 2004 is not taxable. This includes overseas income paid into a Singapore bank account. You do not need to declare overseas income that is not taxable.

There are certain circumstances under which overseas income is taxable:

- It is received in Singapore through partnerships in Singapore.

- Your overseas employment is incidental to your Singapore employment. That is, as part of your work here, you need to travel overseas.

- You are employed outside Singapore on behalf of Government of Singapore

-Ypu need to declare the qualified taxable overseas income under 'employment income' and 'other income' (whichever applicable) in your tax form.

Tax treatment of employer benefits

All gains and profits derived by you in respect of your employment are taxable, unless they are specifically exempt from income tax or are covered by an existing administrative concession. The gains or profits include all benefits, whether in money or otherwise, paid or granted on you in respect of employment. Examples of taxable benefits received from your employer:

1. Accommodation and housing allowance

2. Car provided by employer

3. Reimbursements of medical and dental treatments for dependands other than yourself, your spouse and children

4. Overtime payments

5. Per diem allowances (daily allowance given to employees on overseas trips, out of Singapore, for business purposes), provided the amount is in excess of acceptable rates.

6. Fixed monthly allowance for transport or if mileage on private cars are reimbursed.

7. Fixed monthly meal allowance

Note, however that some of the non-cash benefits (e.g. accommodations) are taxed using special formulas resulting into lower taxation on these benefits-in-kind. Thus, a properly structured compensation package (i.e. salary plus benefits in kind) for the executives can help reduce their individual tax liability in Singapore. Further details on this are outside the scope of this guide.

Capital gain tax, inheritance tax, estate duty

Capital gains may refer to "investment income" that arises in relation to real assets, such as property, financial assets, such as shares or bonds and intangible assets such as goodwill. Singapore does not impose any gains tax.

Inheritance tax is a tax that you have to pay when you die which comes out of the financial estate that you leave behind. In Singapore, it is commonly referred to as Estate Duty. Estate Duty in Singapore has been abolished effective 2008.

Source: http://www.guidemesingapore.com/taxation/personal-tax/singapore-personal-tax-guide

Source: http://www.guidemesingapore.com/taxation/personal-tax/singapore-personal-tax-guide

For more info please visit our website: http://www.smartouch.com.sg

Visit our blog at: http://smartouchint1.blogspot.my/ Click here to subscribe our youtube video

Click here to follow our facebook page to gain more info

Click here to follow our blog for more promotion & product

No comments:

Post a Comment