Pooja Thakur Mahrotri

May 24, 2016 — 5:00 AM SGT

Singapore island-wide mall vacancies at a seven-year high

Rents pressured as 4 million square feet to be added by 2018

.jpg)

Empty storefronts in Singapore’s prime shopping district may become a more common sight.

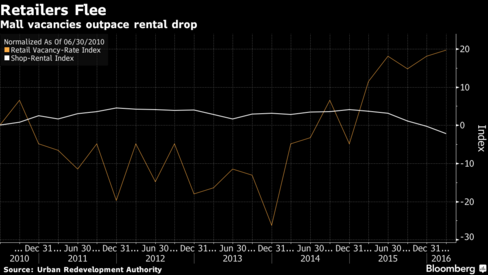

Vacancies in the city’s main Orchard Road area, a magnet for tourists lured by malls and Japanese department stores such as Takashimaya, have risen to a five-year high and across the island, they’ve soared to the highest since 2009. As economies around the region struggle with sluggish growth and consumers rein in spending, property brokers are expecting more retailers to scale back and close shop. And while rents have slumped from a peak in 2014, they haven’t fallen nearly enough to convince some brands to stay.

Here’s five reasons why Singapore can’t expect its status as a shoppers’ paradise to be restored anytime soon:

.jpg)

Tech Savvy

Singaporeans are among the most tech-savvy shoppers in Asia, with a greater percentage turning to online shopping than consumers in Hong Kong and Malaysia.

“Retail is changing because of e-commerce and malls will need to re-position themselves to cater for the future,” said John Lim, chief executive officer at ARA Asset Management, which owns malls in Singapore, Hong Kong and Malaysia. Malls will need to remodel to focus more on food-and-beverage outlets, entertainment, services and banking, and less on fashion and consumer products, he said.

Closing Stores

Some of the biggest retailers are fleeing. Al-Futtaim Group, the distributor in the city-state of major brands including Marks & Spencer and Zara, plans to shutter at least 10 stores in Singapore this year even as the conglomerate expands its footprint in cheaper Asian markets like Malaysia and Indonesia. British brand New Look and French menswear chain Celio plan to close shops in the second half of the year, with more tenants expected to follow suit, according to property broker Cushman & Wakefield Inc.

“After careful review, we’ve decided that Singapore does not have the same potential to be one of our key markets,” New Look said in an e-mailed response to queries from Bloomberg News. The company’s last store in the city-state will close on June 30, it said. Representatives for Al-Futtaim and Celio didn’t respond to requests seeking comment.

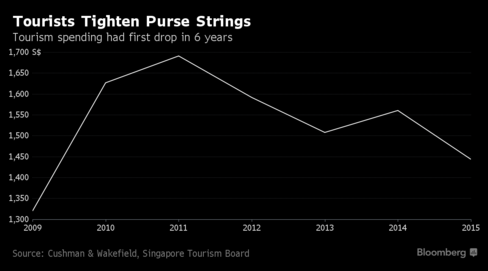

Chinese Pullback

Like Hong Kong, Singapore is reeling from the impact of China’s slowing economy and fewer flashy purchases by visitors from the mainland. Tourists are just not spending as much as they used to.

“Chinese tourists coming to Singapore are looking for experiences rather than goods,” Christine Li, director of research at Cushman & Wakefield in Singapore, said. “In today’s globalized world, where one can almost find the same brand everywhere, differentiation becomes the key ingredient for a successful retail scene, but regrettably, it is lacking in Singapore.”

Economic Headwinds

Domestic shoppers continue to pull back. Singapore’s consumer prices fell for a 17th consecutive month in March, the longest period of decline on record, reflecting the impact of lower oil costs and a weakening economy. If the economic headwinds persist and consumers cut back their discretionary spending amid heightened risks of pay cuts and job losses, prime shopping mall rents could drop as much as 5 percent this year, according to Colliers International.

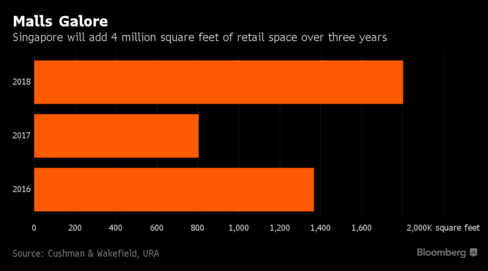

Supply Rising

Rising supply of malls will add pressure to rents and raise vacancy levels. Singapore will add almost 4 million square feet of retail space over the next three years, according to data from Cushman & Wakefield.

Source:

For more info please visit our website: http://www.smartouch.com.sg

Visit our blog at: http://smartouchint1.blogspot.my/

Click here to follow our facebook page to gain more info

Click here to follow our blog for more promotion & product

Click here to learn more about BCA

Click here to learn more about payroll

Click here to learn more about attendance

No comments:

Post a Comment